1. market conditions: aromatics rose across the board to lead the chemical sector to pick up.

Recently, China's chemical futures market changed the previous downturn, showing a collective strong pattern, aromatics market ushered in a strong rise in the market, becoming the core engine of the chemical sector. According to data from the Business News Agency, on January 26, the main PTA futures contract approached 5500 yuan/ton, a new high. The main contract of pure benzene futures has continued to rise since the beginning of January around 5400 yuan/ton. Judging from the monthly trend, the price of pure benzene has reached 7543 yuan/ton on January 23, up 4.26 from 7234.67 yuan/ton at the beginning of the month. At the same time, benefiting from the significant recovery of the industry boom, the share price of the head enterprises also "rose".

PX and PTA rose together

the prices of all links in the aromatic hydrocarbon industry chain are rising simultaneously, and the market performance is strong. In terms of PX, according to data from PetroChina and Chemical Network, on January 26, the ex-factory prices of Hainan Refining and Chemical and Yangzi Petrochemical PX superior products were both 7300 yuan/ton, showing a steady upward trend. In terms of PTA, business agency data show that as of January 26, the spot price of PTA in East China rose to 5341 yuan/ton, up 6.63 percent from January 19. PTA processing fees also rose steadily to 400 yuan/ton. Overall PX and PTA form a coordinated upward trend.

This pattern of price linkage between upstream and downstream of the industrial chain reflects the improvement of the overall supply and demand relationship of the aromatics industry chain. As the core raw material of PTA, the price increase of PX directly pushes the cost end of PTA up. PTA processing fee rose to 400 yuan/ton, indicating that the profitability of PTA enterprises improved and processing profits expanded. This kind of "raw material price increase + processing fee recovery" double good, for PTA enterprises to bring a rare profit window period.

Pure benzene and styrene led the rise strongly.

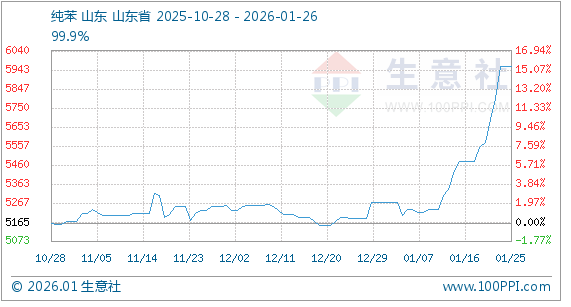

Judging from the price trend, the price performance of pure benzene and styrene is more strong. In terms of pure benzene, according to data from the Business News Agency, as of January 26, domestic mainstream manufacturers quoted pure benzene in the range of 5200-6000 yuan/ton, of which Qilu Petrochemical quoted 6000 yuan/ton, a significant increase from the beginning of the month. The benchmark price of pure benzene has reached 5960 yuan/ton, up 13.12 percent from 5268.67 yuan/ton at the beginning of this month.

As the main downstream product of pure benzene, styrene is also strong. Since the beginning of this month, the price of styrene futures 2603 contract has risen from 7124 yuan/ton to 7708 yuan/ton, an increase of 8.19, and the position has climbed to 423400 lots, a stage high. Some market analysts pointed out that the current price of pure benzene and styrene has got rid of the previous low shock range and entered a new round of upward channel.

The strong performance of pure benzene and styrene, on the one hand, benefited from the cost end support, on the other hand, also reflects the steady release of downstream demand. Styrene futures positions climbed to a phased high of 423400 lots, indicating that the market is optimistic about the market outlook and investors are actively building positions. This pattern of futures and spot rises and positions are magnified, which often indicates sufficient upward momentum in prices.

2. Drivers: Cost Support, Supply Disruptions and Market Sentiment Resonance

for the collective rise in the current round of aromatics products, institutions generally believe that it is not driven by a single factor, but the result of cost support, supply disturbances and macro-emotional resonance.

The cost side strongly supports the price of the industrial chain.

As the source product of the aromatics industry chain, pure benzene has shown a clear upward trend recently. Futures and spot prices go hand in hand, and the market performance is strong. The strong price of pure benzene led the rise, driving the cost center of gravity of the entire aromatic chain up. As a by-product of oil refining, ethylene cracking, PX production process, the supply has rigid characteristics, in the domestic PX plant high load operation background, the stock device is difficult to provide further increment.

This rigid support at the cost end gives the price of the aromatics industry chain a strong upward momentum. As a by-product, the output of pure benzene is directly related to the operating rate of the main unit of oil refining, ethylene cracking and PX. The current high-load operation of the domestic PX plant means that the growth space of pure benzene production is limited and the supply elasticity is small. With demand remaining stable, supply rigidity makes prices easy to rise and fall.

Frequent supply-side disturbances exacerbate short-term tensions

unexpected production cuts at home and abroad have exacerbated short-term tensions. According to industry monitoring, major Asian PX producers such as South Korea's GSCaltex and SK Geocentric have reduced their operating rates to 60-85%, and some 2.6 million-ton/year PX plants in China have also entered the maintenance period. At the same time, with the withdrawal of overseas ethylene, refining units and the trend of light feedstock, the supply of by-product aromatics has decreased, and imports are expected to shrink.

As an important PX supplier in Asia, South Korea's main producer operating rate has dropped to 60-85%, which means that the regional supply capacity has dropped by 15%-40%. Some 2.6 million tons/year PX units in China have entered the maintenance period. Based on a single unit, the monthly supply will be reduced by about 217000 tons (2.6 million tons/12 months) during the maintenance period. The combination of these supply-side disruptions creates a significant supply gap for the market in the short term, pushing prices upward.

The withdrawal of overseas refining units and the trend of lighter feedstocks are long-term factors affecting the supply of aromatics. The proportion of aromatics produced by the cracking of light feedstocks (e. g. ethane, propane) is much lower than that of heavy feedstocks (e. g. naphtha), which has led to a slowdown in global aromatic supply growth, and the expected contraction of imports has reinforced domestic market tensions.

Market sentiment transmission consolidates price increases

market sentiment, Sinopec repeatedly raised the price, aromatic hydrocarbon port inventory ushered in the first time to go to the warehouse (East China port pure benzene inventory 297000 tons, down 8.33 percent month-on-month), more sentiment along the industrial chain conduction, further consolidate the price increase trend.

As a leading enterprise in the domestic aromatics market, Sinopec's quotation adjustment has a weather vane significance for the market. Many times the price increase to release a clear price signal, leading the market is expected to be good. Pure benzene stocks in East China ports fell 8.33 month-on-month, an important signal of market destocking. Falling inventories mean improved supply and demand and increased spot tensions, supporting continued upward movement in prices.

Lido sentiment is transmitted along the industrial chain, forming a linkage effect of "pure benzene up & rarr;PX up & rarr;PTA up & rarr; Polyester up. This self-reinforcing mechanism of expectations amplifies the magnitude and speed of price increases in the short term. At present, the bottom of the chemical sector has stabilized, and the aromatics industry chain, with strong fundamentals, is becoming one of the areas with the highest market attention.

3. industry pattern: refining integration advantages highlighted, leading enterprises fully benefit

evolution of global aromatics production capacity pattern

at present, China has become the world's most important concentration of aromatic production capacity, contributing nearly 90% of the world's pure benzene production capacity during 2020-2025. With the domestic refining integration project put into operation into the end, the global aromatic production capacity growth rate will decline sharply, the scarcity value of the stock capacity highlighted. And petrochemical as a late-developing advantage of the industry, the head of enterprises focused on capacity expansion in recent years, cost advantages and carbon emissions advantages to further strengthen, the strong Hengqiang.

China contributes nearly 90% of the world's pure benzene new production capacity, indicating that the global aromatics industry center of gravity has shifted to China. This change in production capacity pattern has significantly enhanced the voice of Chinese enterprises in the global aromatics market. The domestic refining and chemical integration project is coming to an end, which means that the industry has entered the "stock competition period" from the "capacity expansion period". At this stage, leading enterprises with scale advantages, cost advantages and integrated layout will occupy a more favorable competitive position.

Increased profitability of leading enterprises

therefore, leading enterprises with scale advantages, such as Rongsheng Petrochemical, Hengli Petrochemical, Oriental Shenghong, Hengyi Petrochemical, etc. in the current round of aromatics market upward fully benefit. Take Rongsheng Petrochemical as an example, its share price rose as much as 17.87 per cent in a single week from January 19 to January 23, significantly outperforming the overall performance of the refining and chemical sector.

As a leading domestic refining and chemical integration enterprise, Rongsheng Petrochemical's 40 million-ton/year refining and chemical integration project led by Zhejiang Petrochemical has the ability to connect the whole industrial chain of "crude oil-PX-PTA-polyester", the refining and chemical integration rate is the first in the world, and the production strategy can be flexibly deployed according to downstream demand.

In terms of aromatic hydrocarbon series production capacity, Rongsheng Petrochemical has absolute advantages. It has PX production capacity of 10.4 million tons/year and PTA production capacity of 21.5 million tons/year, both of which are the largest in the world. Pure benzene production capacity is 2.8 million tons/year (in addition, CICC Petrochemical has a production capacity of 480000 tons/year), ranking first in China. Styrene production capacity is 1.3 million tons/year. The profitability of the company's aromatics sector is expected to fully benefit from the current round of price increases in the whole industry chain.

The case of Rongsheng Petrochemical fully reflects the advantages of refining and chemical integration. The whole industrial chain of crude oil-PX-PTA-polyester is connected, which enables the company to maximize profits in the price fluctuation of all links of the industrial chain. When PX and PTA prices rise, the company is both a raw material supplier and a product manufacturer, able to lock in more industrial chain profits. The scale advantage of 10.4 million tons/year PX production capacity and 21.5 million tons/year PTA production capacity enables the company to have stronger bargaining power in raw material procurement and product sales.

Medium-and long-term boom cycle continues

in the medium to long term, the aromatics sector boom cycle will continue. Aromatics production capacity growth rate is much lower than olefins, PTA full-year no new capacity in 2025, PX, styrene new capacity concentrated in the third quarter after the release, while downstream polyester demand steadily released, supply and demand relationship improvement certainty is strong.

In 2019-2024, China's apparent consumption of pure benzene grew at an average annual rate of nearly 13%, of which downstream domestic substitution contributed about 6 percentage points and endogenous demand growth contributed about 7 percentage points, with a clear long-term positive trend.

In 2025, PTA will have no new capacity for the whole year, which means that the growth of the supply side is stagnant, while the downstream polyester demand is steadily released, and the gap between supply and demand will gradually appear. PX, styrene new capacity concentrated in the third quarter after the release, indicating that the first half of the tight supply pattern will continue to provide support for prices.

The average annual growth rate of China's apparent consumption of pure benzene is nearly 13%, which is much higher than the GDP growth rate, reflecting the rapid expansion of downstream applications of aromatics. Downstream domestic substitution contributed about 6 percentage points, indicating that the substitution of domestic aniline, phenol, caprolactam and other products for imports is accelerating; endogenous demand growth contributed about 7 percentage points, reflecting the electronic chemicals, pharmaceutical intermediates, high-end materials and other emerging areas of demand for aromatics continued to grow.

Therefore, Rongsheng Petrochemical and other leading enterprises with scale advantages and integrated layout will continue to obtain excess returns in the current boom cycle. For practitioners in the chemical industry, it is recommended to pay close attention to the changes in the inventory of the aromatics industry chain, the progress of plant maintenance, the pace of downstream demand release, as well as the changes in capacity utilization and profitability of leading enterprises, to grasp the trading opportunities and investment window period of the current round of aromatics market.

![]() +086 1911-7288-062 [ CN ]

+086 1911-7288-062 [ CN ]